Angel Investing in the UAE: Your Complete 2025 Guide to Valuing Startups

Did you know the UAE's angel investment ecosystem has grown significantly, with investments typically ranging from $50K to $5 million, and Dubai Angel Investors alone deploying between $100,000 to $250,000 in each company they invest in? Unlike other guides that focus solely on theory, we provide practical, UAE-specific insights on startup valuation that address local market conditions, regulatory considerations, and real investor expectations. This comprehensive guide offers actionable frameworks for evaluating investment opportunities in the rapidly growing UAE startup ecosystem.

Join our exclusive UAE angel investor community for curated deal flow and expert insights: [Sign up for premium deal access]

Why Angel Investing in the UAE is Thriving in 2025

The UAE has positioned itself as the premier startup hub in the MENA region, offering unique advantages that make it exceptionally attractive for angel investors. The UAE has established itself as a hub for entrepreneurship and innovation, attracting a growing number of angel investors, with the government's continued commitment to economic diversification driving substantial opportunities.

The tax-free environment, strategic location connecting East and West, and Vision 2071's focus on making the UAE the world's best country by its centennial create compelling reasons for angel investment. Leading angel investors and networks, such as Emirates Angels Investors Association, Dubai Angel Investors (DAI), Dr. Muna Al Qassab, Khaled Al-Ali, and Sama Al Habtoor, focus on fintech, AI, healthcare, and female-led businesses.

Consumer startups in F&B, e-commerce, and technology sectors represent particularly high-signaling opportunities. Success stories like Careem's $3.1 billion acquisition by Uber and Souq's acquisition by Amazon demonstrate the massive potential for returns in the region. The UAE has committed to a 10-year, $1.4 trillion investment framework in the United States after top UAE officials met President Donald Trump this week, showcasing the country's significant investment capacity and international ambitions.

Unlike other guides that focus on global markets, we understand the unique dynamics of the UAE's business environment, including DIFC regulations and the specific requirements for operating in free zones.

Sign up for our newsletter to receive exclusive UAE startup deals and market insights: [Join our community]

Essential Valuation Methods Every UAE Angel Investor Must Know

The Scorecard Valuation Method

Key to the Scorecard Method is a good understanding of the median (and range) of pre-money valuation of pre-revenue companies in a region. This method, developed by Bill Payne, remains the most practical approach for UAE angel investors.

Step-by-step process:

- Determine baseline valuation: Research median pre-money valuations for UAE startups in your target sector

- Assess key factors: Evaluate management team (30% weight), market opportunity (25% weight), competitive environment (15% weight), and other factors

- Apply regional multipliers: Adjust for UAE-specific advantages like tax benefits and strategic location

For purposes of this report, let's assume the midpoint between the average Pre-Seed Deal ($4M) and Seed Stage Deal ($5M) is an appropriate median local pre-money valuation, that is, $4.5 million.

The Berkus Method for Early-Stage UAE Startups

Venture capitalist Dave Berkus has developed a formula known as the Berkus Method for valuing pre-revenue startups. Try it to help determine your company's valuation. Using Berkus's specific example, begin with $2.5 million and assign $500,000 to each of five key success metrics: idea, prototype, team, strategic relationships, and product/service rollout, including sales.

For UAE startups, consider these factors:

- Sound idea: Addresses significant market need in the region

- Working prototype: Reduces technology risk

- Quality management team: Proven track record in MENA markets

- Strategic relationships: Local partnerships and regulatory approvals

- Revenue traction: Early customer validation

The Venture Capital Method

Post-money valuation = Terminal value ÷ Expected Return on Investment (ROI) Pre-money valuation = Post-money valuation — Investment

This method works particularly well for UAE tech startups where clear exit paths exist through IPOs on ADX or acquisitions by regional conglomerates.

Comparative Market Analysis

Unlike other guides that use outdated examples, we leverage current UAE market data. VCs and angels also use the comparable transactions approach, where you consider other transactions in the same sector involving companies of similar size to arrive at a fair value for the startup in question.

Research recent transactions in the UAE ecosystem, considering:

- Regional tech acquisitions

- Public company valuations on ADX and DFM

- International comparables adjusted for local market conditions

Critical Due Diligence Checklist for UAE Angel Investors

Regulatory and Compliance Assessment

Before making any investment, verify:

- Business license compliance: Ensure proper registration with relevant authorities

- Free zone requirements: Understand specific regulations for DIFC, ADGM, or other free zones

- Visa and employment status: Confirm founders' legal status to operate in the UAE

- Intellectual property protection: Verify trademark and patent registrations locally

Financial Analysis Framework

Revenue Model Evaluation:

- Recurring vs. one-time revenue streams

- Customer acquisition cost (CAC) and lifetime value (LTV) ratios

- Market penetration strategy specific to UAE demographics

Growth Metrics:

- Monthly recurring revenue (MRR) growth rates

- User engagement and retention metrics

- Scalability potential across GCC markets

Team and Execution Assessment

Angel investors in the UAE typically look for innovative business models, strong founding teams, scalable technology, market demand, and clear revenue potential. They also prioritize startups that have some level of traction, such as early customers, partnerships, or a working prototype.

Management Team Due Diligence:

- Previous startup experience in MENA region

- Cultural understanding and local market knowledge

- Technical capabilities and execution track record

- Advisory board strength and investor network

Common Investment Mistakes to Avoid in the UAE Market

Over-relying on Real Estate Investment Models

Many UAE investors come from real estate backgrounds and mistakenly apply property investment principles to startups. Unlike real estate, startups require:

- Higher risk tolerance for potential exponential returns

- Longer investment horizons (5-7 years vs. 2-3 years)

- Active mentorship and strategic guidance

Ignoring Cultural and Market Nuances

As the UAE continues to position itself as a startup hub, the role of angel investors in fueling innovation, job creation, and economic growth will remain critical. Successful UAE angel investors understand:

- Local consumer behavior and preferences

- Regulatory requirements across different emirates

- Cultural considerations for product-market fit

Chasing Global Trends Without Local Validation

Avoid investing in startups that simply copy successful international models without adapting to local markets. Focus on businesses that demonstrate:

- Clear understanding of UAE customer needs

- Proper market research and validation

- Realistic go-to-market strategies for the region

Inadequate Portfolio Diversification

As our network of experienced UAE angels has learned, successful portfolios require:

- Sector diversification across fintech, healthtech, e-commerce, and foodtech

- Stage diversification from seed to Series A

- Geographic balance between UAE-focused and regional expansion plays

Essential Tools and Resources for UAE Angel Investors

Local Investment Platforms and Networks

Regional Organizations:

- Emirates Angels Investors Association - Network supporting early-stage startups

- Dubai Angel Investors (DAI) - Micro-venture capital firm with over 100 investors

- Abu Dhabi investment networks and ADGM-based funds

Research and Due Diligence Tools:

- Crunchbase for global startup intelligence

- MAGNiTT for MENA-specific startup data

- In5 and other local incubator networks for deal flow

UAE-Specific Resources

Regulatory Information:

- UAE Central Bank guidelines for fintech investments

- DIFC and ADGM regulatory frameworks

- Local legal and tax advisory services

Market Intelligence:

- MENA startup funding reports

- Local industry associations and chambers of commerce

- Government economic development agencies

Building Your Angel Investment Network

The importance of joining a community cannot be overstated. What makes us different is that we are not a fund. We are a fully-capitalized investment company and our angels range from seasoned investors, tech entrepreneurs, venture fund partners, senior executives of successful companies and one institutional investor.

Get exclusive access to vetted UAE startup deals by joining our premium investor network: [Subscribe now]

The Future of Angel Investing in the UAE

The future of angel investing lies in the collaboration between human expertise and AI insights, providing investors with a comprehensive approach that ensures a better chance of success in an unpredictable market. Smart UAE angel investors are already leveraging:

Technology-Enhanced Due Diligence:

- AI-powered market analysis tools

- Automated financial modeling platforms

- Digital deal management systems

Sector-Specific Opportunities:

- Fintech innovations aligned with UAE's digital transformation

- Healthcare technology addressing regional medical tourism

- Sustainability solutions supporting UAE's climate commitments

Regional Expansion Potential:

- Startups positioned for GCC market expansion

- B2B solutions targeting the region's large enterprise market

- Consumer brands with potential for international scaling

Conclusion

The UAE's angel investment landscape offers exceptional opportunities for experienced investors who understand local market dynamics and apply rigorous valuation methodologies. Unlike other guides that provide generic advice, we've outlined UAE-specific strategies that address local regulatory requirements, cultural considerations, and market opportunities.

Success in UAE angel investing requires combining proven valuation methods with deep local market knowledge, active portfolio management, and strong network connections. The tax-free environment, strategic location, and government support for innovation create unique advantages for early-stage investors.

Ready to start your UAE angel investing journey? Join our exclusive community for curated deal flow, expert mentorship, and access to the region's most promising startups: [Get started today]

Meta Description

Learn how to value startups as an angel investor in the UAE with our comprehensive 2025 guide. Includes practical valuation methods, due diligence checklists, and local market insights. Join our community for exclusive deals!

Suggested Internal Links

- Link to "UAE Startup Ecosystem Guide" (when published)

- Link to "Legal Requirements for Angel Investors in UAE" (when published)

- Link to "Portfolio Management for Angel Investors" (when published)

Suggested External Links

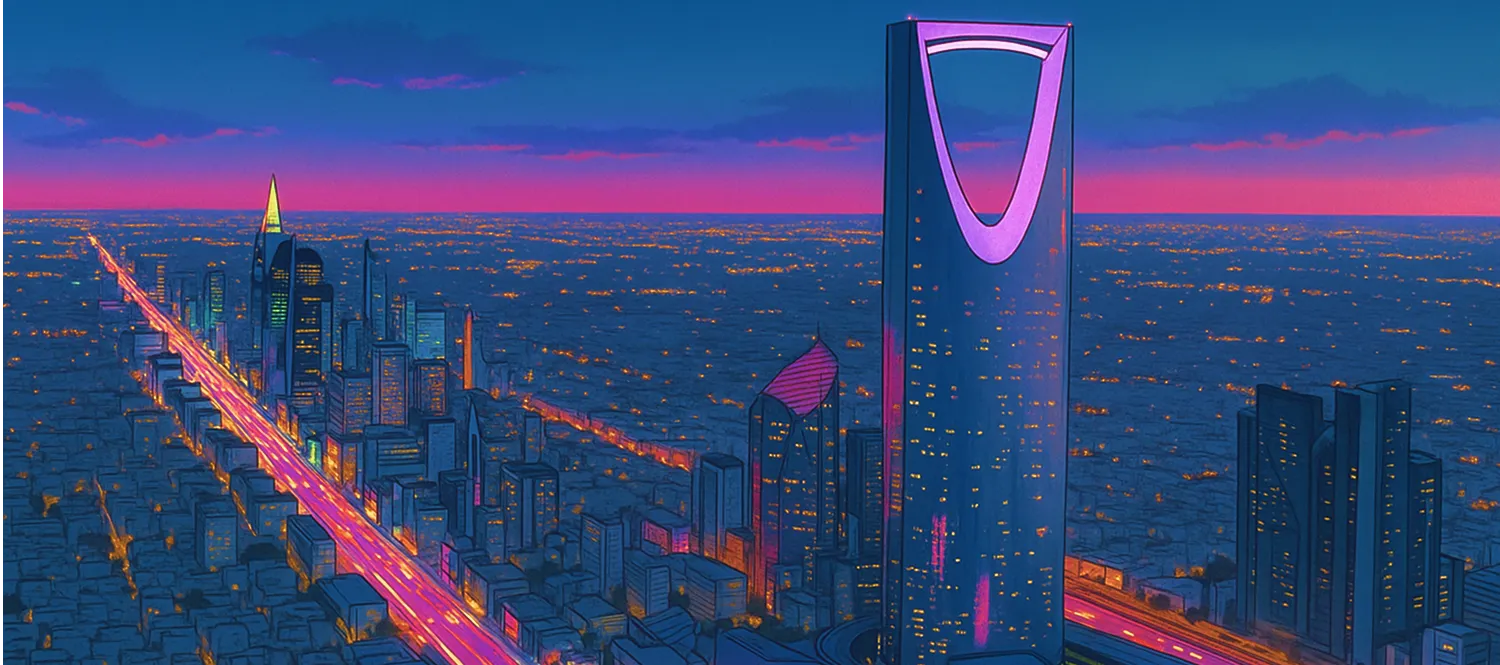

Featured Image Suggestion

Dubai skyline at sunset with floating startup logos and investment icons, representing the UAE's thriving angel investment ecosystem.